CHICAGO / LONDON / DUBAI – January 24, 2026 – The “Yellow Metal” is no longer just a hedge; it has become the global financial anchor of 2026. In a week defined by escalating geopolitical friction and domestic policy shocks, gold spot prices officially breached the $4,950 per ounce mark today, briefly touching a psychological peak of $4,988 before settling just shy of the $5,000 milestone.

The nearly 9% surge this week represents one of the largest five-day advances in history, driven by a perfect storm of revolutionary unrest in Iran, a deepening rift between the White House and the G7, and systemic fears regarding the independence of the U.S. Federal Reserve.

The Drivers: Why $5,000 Gold is Now Reality

While gold has been on a “slow burn” rally since late 2025, three specific catalysts turned the past 72 hours into a full-scale stampede toward safe-haven assets:

1. The Iran Crisis & G7 Fragmentation

Despite President Trump’s mid-week assertions that the “killing has stopped” in Iran, G7 intelligence reports of a death toll exceeding 20,000 have sent a chill through global markets. Investors are pricing in the high probability of a total regime collapse in Tehran, which would fundamentally redraw the energy and security map of the Middle East.

2. The Fed Under Fire

Confidence in the U.S. Dollar took a direct hit following reports that the Department of Justice has subpoenaed the Federal Reserve regarding internal administrative costs. This move, widely interpreted as an attempt to undermine Fed Chair Jerome Powell, has fueled fears of “political inflation.”

“When the independence of the world’s reserve currency issuer is questioned, gold is the only logical exit ramp,” says Elena Vance, Chief Macro Strategist at Zurich Capital.

3. The “Greenland Factor”

Ongoing friction between Washington and NATO allies over “strategic access” to Greenland has introduced a level of Western diplomatic instability not seen in decades. The uncertainty has triggered a massive rotation out of European and American equities and into “hard” assets.

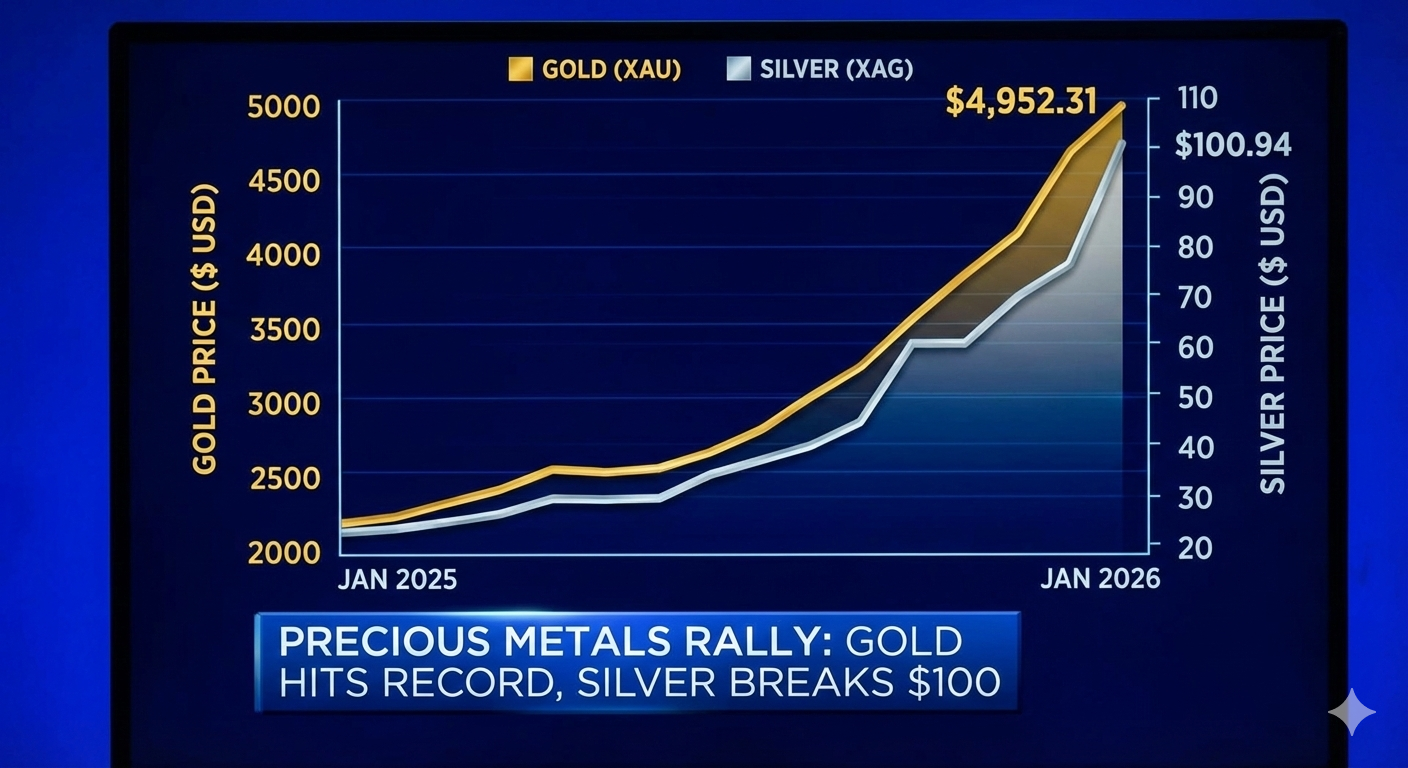

A New Era for Precious Metals

Gold isn’t the only metal rewriting the record books. The rally has spilled over into the entire precious metals complex, signaling a broader “de-dollarization” trend among institutional investors and central banks.

| Metal | Current Price (Jan 24, 2026) | YTD Growth | Note |

| Gold | $4,952.31 | +14.2% | Approaching the $5,000 “Gilded Ceiling.” |

| Silver | $100.94 | +22.5% | First time in history silver has cleared $100. |

| Platinum | $2,744.40 | +11.8% | Driven by industrial demand in 2nm chip labs. |

| Palladium | $1,999.64 | +9.1% | Recovering on supply chain fears. |

The “AI Realism” Connection

Surprisingly, the 2nm chip revolution and the shift toward Agentic AI are also providing a floor for gold. As organizations move toward physical, on-device AI infrastructure, the demand for gold’s unique conductive properties in high-end circuitry has reached an all-time high.

“We are seeing a convergence of ‘Digital Realism’ and ‘Physical Reality,'” notes tech analyst Octavio Garcia. “The more we rely on advanced AI, the more we rely on the physical elements required to build it. Gold is the bridge.”

What the “Big Banks” Are Saying

The $4,950 level has forced major institutions to scrap their previous 2026 forecasts:

-

Goldman Sachs: Has officially raised its year-end target to $5,400, citing central bank diversification.

-

JP Morgan: Now predicts gold will average $5,055 through Q4 2026.

-

Morgan Stanley: Warns of “demand destruction” in the jewelry sector but admits institutional inflows are at record “all-time” highs.

The Bottom Line: With the world currently shrouded in “digital darkness” in some regions and political firestorms in others, the ancient allure of bullion has never been stronger.

700 701 702 703 704 705 706 707 708 709 710 711 712 713 714 715 716 717 718 719 720 721 722 723 724 725 726 727 728 729 730 731 732 733 734 735 736 737 738 739 740 741 742 743 744 745 746 747 748 749 750 751 752 753 754 755 756 757 758 759 760 761 762 763 764 765 766 767 768 769 770 771 772 773 774 775 776 777 778 779 780 781 782 783 784 785 786 787 788 789 790 791 792 793 794 795 796 797 798 799 800 801 802 803 804 805 806 807 808 809 810 811 812 813 814 815 816 817 818 819 820 821 822