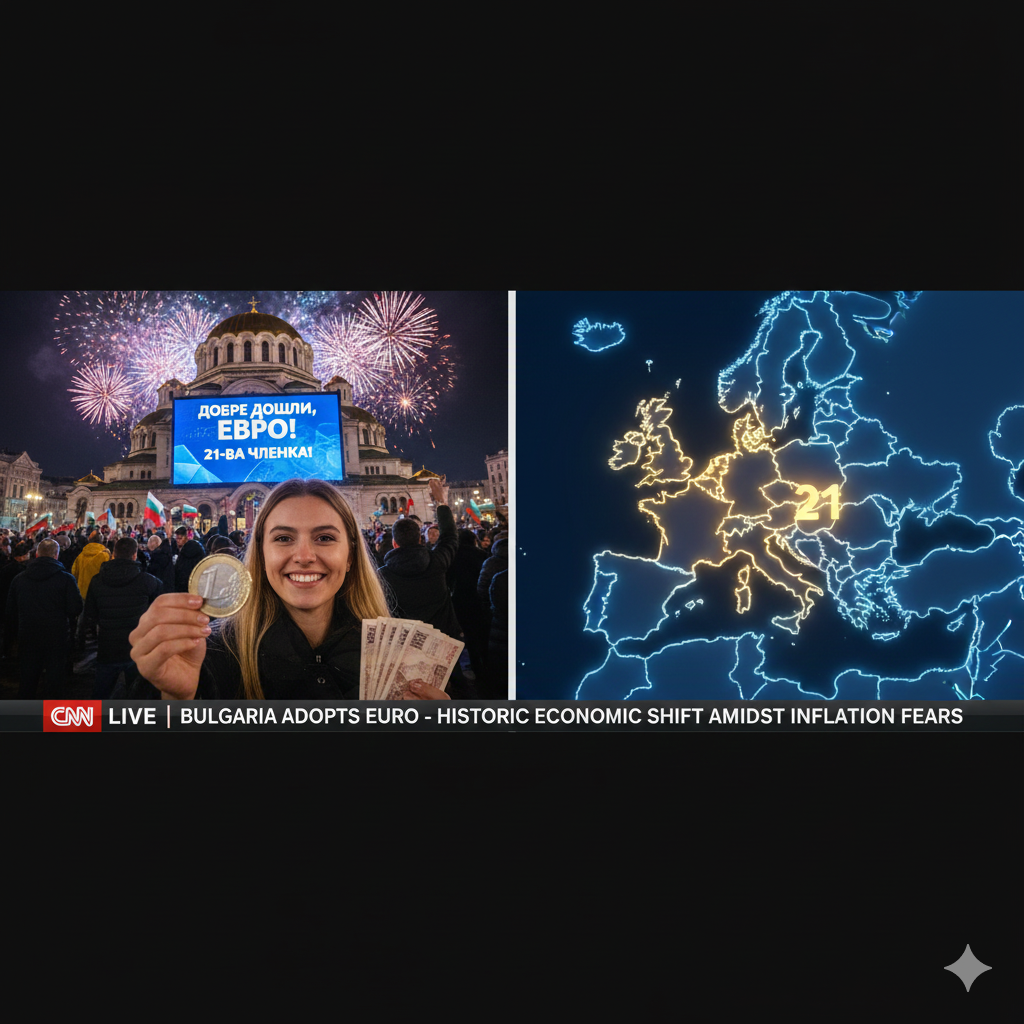

SOFIA, BULGARIA – January 1, 2026 – Today marks a monumental day for Bulgaria as the nation officially adopted the Euro, becoming the 21st member state of the eurozone. At the stroke of midnight, the lev was retired, and the single European currency became the sole legal tender, cementing Bulgaria’s integration into the economic heart of the European Union.

Celebrations across Sofia and other major cities were vibrant, with fireworks lighting up the sky and crowds gathering to witness the historic transition. However, the jubilant mood was notably tempered by an undercurrent of public anxiety over potential price hikes and the broader economic implications of joining the Euro.

A Decade-Long Journey Culminates

Bulgaria’s journey to the eurozone has been a decade in the making, involving stringent economic reforms to meet the demanding Maastricht criteria, including strict controls on inflation, government debt, and exchange rate stability. Supporters argue that joining the Euro will bring numerous benefits:

-

Economic Stability: Enhanced economic stability and reduced exchange rate risks, fostering greater confidence among investors.

-

Lower Borrowing Costs: Access to lower interest rates within the eurozone, benefiting businesses and consumers.

-

Increased Trade: Easier trade and tourism with other eurozone countries, boosting economic growth.

-

Greater Integration: Deeper integration into the EU’s single market and stronger political ties.

“This is a proud day for Bulgaria, a testament to years of hard work and dedication,” stated Prime Minister Georgi Dimitrov during an official ceremony in Sofia, holding aloft the first Euro banknotes officially dispensed from a Bulgarian ATM. “We are now firmly anchored in the heart of Europe, ready to reap the benefits of this historic step.”

Public Apprehension: The “Euro-Inflation” Fear

Despite the official optimism, a significant portion of the Bulgarian population remains apprehensive. Surveys conducted in the weeks leading up to the transition revealed widespread concern about “Euro-inflation” – the phenomenon where prices for goods and services tend to increase following a currency switch.

-

Price Rounding: Many fear that retailers will round up prices to the nearest Euro, effectively increasing costs for consumers.

-

Loss of Monetary Policy: Concerns exist about the loss of an independent monetary policy, meaning the Bulgarian National Bank will no longer be able to devalue the lev to make exports cheaper or cushion economic shocks.

-

Cost of Living: For many ordinary citizens, the primary worry is that their wages will not keep pace with potential price increases, leading to a decline in their purchasing power.

The government has launched extensive public information campaigns and introduced measures to monitor prices, vowing to crack down on any opportunistic price gouging. However, regaining full public trust will be a critical challenge in the coming months.

What’s Next for the Eurozone

Bulgaria’s entry strengthens the eurozone, adding its economy of approximately 70 billion Euros and a population of nearly 7 million people. While the immediate focus is on a smooth transition for Bulgaria, its inclusion also reignites discussions about potential future expansions, with countries like Romania still aspiring to join the currency bloc.

As Bulgarians wake up to a new currency, the true impact of this historic decision will unfold over the coming year, carefully watched by both its citizens and the broader European Union.

700 701 702 703 704 705 706 707 708 709 710 711 712 713 714 715 716 717 718 719 720 721 722 723 724 725 726 727 728 729 730 731 732 733 734 735 736 737 738 739 740 741 742 743 744 745 746 747 748 749 750 751 752 753 754 755 756 757 758 759 760 761 762 763 764 765 766 767 768 769 770 771 772 773 774 775 776 777 778 779 780 781 782 783 784 785 786 787 788 789 790 791 792 793 794 795 796 797 798 799 800 801 802 803 804 805 806 807 808 809 810 811 812 813 814 815 816 817 818 819 820 821 822